Separate Tax Limitation Proposal

Tax Limitation Proposal

November 5, 2024 Election

- Eaton County is asking voters to consider a tax limitation proposal that would increase the amount the County can levy by an additional 3.0 mills for operations and critical services.

- The Tax Limitation is governed by the State Constitution, which allows Counties, Schools, and Townships to levy up to 18 mills for operations. Eaton County chose a 15 mill limitation in 1978 and has not adjusted it since. This proposal raises the total levy to 18 mills, with that additional 3 mills going to just the County. This would equate to roughly $12.0 million annually.

- This proposal does not mandate that the Board has to levy up that amount but does increase the limitation the Board of Commissioners considers each year during the budget process.

- Eaton County’s current limitation amount was set in 1978 at 5.5 mills for the County. With Headlee and Proposal A, that amount has decreased to 5.2096 mills.

- If approved by voters, any additional millage will not take effect until the summer of 2025.

- Ballot language for the tax limitation proposal is set by state statute and cannot be altered by the County. It can be viewed toward the bottom of this page.

- On average, this will cost taxpayers $18 dollars a month, or $216 annually.

Why is the County doing this?

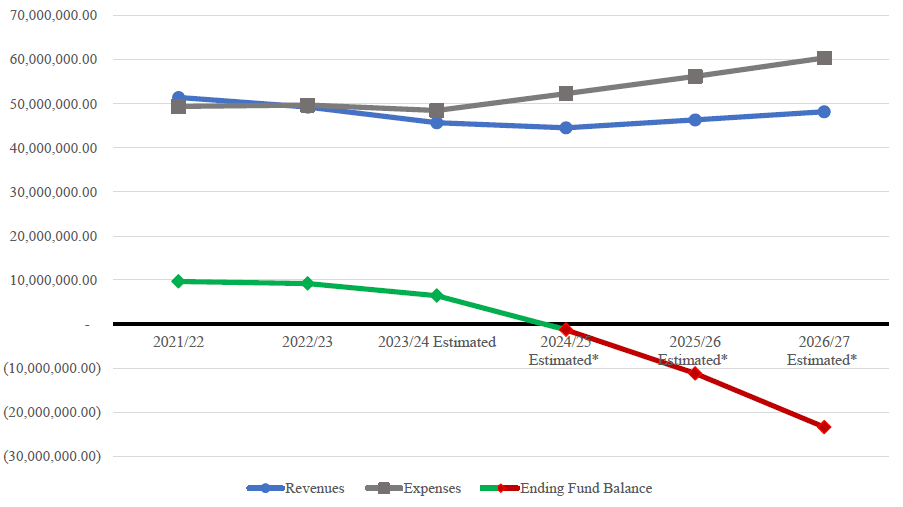

After adopting the 2024/25 budget, the projected fund balance is $3.1 million. Without new revenue, the County faces a $9.5 million shortfall in FY 2025/26 and $21.5 million in FY 2026/27, leading to potential cuts in staff, services, and hours of operation.

The Sheriff’s Office, Trial Courts, and Prosecuting Attorney’s Office account for roughly 65% of the County budget and will likely be the most impacted if cuts in staffing and services are necessary, especially any nonmandated services such as the Sheriff’s Road Patrol.

Eaton County can no longer use continuation budgets to stay balanced. Past reliance on one-time grants and COVID relief is no longer an option. Rising technology costs, pension obligations, and infrastructure projects, like the Animal Control building, have created urgent financial challenges.

Without additional revenue, reductions in services and staffing will be necessary, likely impacting public safety and non-constitutionally mandated services. These services include Sheriff Road Patrol, Animal Control, and other staff throughout almost every department. The County will have to consider lowering hours of operations, selling assets, or eliminating services outright.

Below is an illustration showing expenses outpacing revenue and the General Fund Balance (the County’s fund to pay for operations and services) decreasing year after year.

PROJECTED REVENUES OVER EXPENSES, 2021 TO 2027

*Estimated fiscal years are based on 5-year historical changes and are not final until each future budget is adopted, including the 2024/25 budget.

What happens next?

The County Advisory Tax Limitation Committee (CATLC) held a public meeting on Thursday, June 6. The Committee reviewed financials and determined an increase to the County’s tax levy is necessary to maintain operations and services, submitting its recommended 3.0 mill increase to the amount the County can levy each year. The Board is required to pass a resolution submitting the determination via a ballot proposal for the public to vote on this November.

Frequently Asked

Questions

What is the County's proposal?

Eaton County is asking voters to consider a tax limitation proposal that would increase the amount the County can levy by an additional 3.0 mills. Each fiscal year, the County Board determines how much it will levy during the budget cycle. It does not have to hit that maximum limitation. This proposal would increase that limitation for Boards to consider each year.

Why did the Board take action?

After the adoption of the 2024/25 budget and continued deferred maintenance of facilities and technology infrastructure, the projected ending fund balance for this fiscal year is $3.1 million. Without additional revenue, the projected budget shortfall is estimated to be $9.5 million in FY 2025/26 and $21.5 million in FY 2026/27. The County will need to cut staff, services, and hours of operation unless it can secure additional revenue.

What are the County's biggest expenses?

The County’s largest expenses come from its three biggest offices—the Sheriff’s Office, the Prosecuting Attorney’s Office, and the Trial Courts. These expenses are coupled with record-high inflation, an increase in pension obligation costs, and deferred maintenance projects coming to a head. If more revenue is not secured, every office will likely experience reductions or cuts.

What services and expenses are not associated with this proposal?

The Eaton County Road Commission is not a part of the County, it is an external agency that is not funded by Eaton County. Parks and Recreation and 9-1-1 Central Dispatch are not funded by the General Fund, so they are not affected by this proposal or the operating expenses associated.

Is the County planning to eliminate services?

Without additional revenue, the compounding nature of the County’s projected financial shortfalls will lead to drastic changes in the services the County can afford to provide residents. These changes may include a reduction in the level of public safety available and a reduction in any non-constitutionally mandated services the County currently provides (e.g., Sheriff Road Patrol). Reductions can include a combination of eliminating vacant positions, employee layoffs, reductions in hours of operation, and/or the sale of assets. Apart from securing additional revenue, the only path forward is a significant reduction in County staff and services, which will impact all residents of Eaton County.

Why have there been infrastructure projects if there is no money?

Almost every major project done in the last five years has been thanks to grant funding from the state or federal government (Youth Facility expansion, recycling trailer, etc.). Thanks to some of the capital improvements like the solar array, there has been a roughly 30% reduction in the County’s monthly energy bill. The County has also applied to receive an estimated $1.3 million in federal reimbursement from the Inflation Reduction Act, if successful, this funding will only stand to improve the County’s break-even point for this capital asset.

Department Budget Presentations

View each office’s video presentation on what they provide to the public, and learn what is at risk:

Playlist

Tax Limitation Alteration Process

What is a Tax Limitation Alteration?

The statutory process for a Board of Commissioners to alter or extend the tax amount it is authorized to levy to support general operations. The authorized amount also goes towards the operations of Non-Charter Townships and Intermediate School Districts. Eaton County has not altered its limitation since 1978.

The Board voted unanimously on May 15 to form the County Advisory Tax Limitation Committee to review financials and determine what change is necessary to maintain operations and services.

By law, the Board must place that adjustment on a ballot proposal for public consideration.

STEP 1

Committee is Formed

The County Advisory Tax Limitation Committee (CATLC) was created to review financials and determine if there is a necessary change to how much the County can levy residents (up to an additional 3.0 mills as allowed by the Michigan Constitution, dispersed between the County, Townships, and Intermediate School District).

By law, the Committee must be made up of:

- Chair of the Ways and Means Committee

- County Treasurer

- Rep of the public appointed by the Board

- Rep of the public appointed by the Probate Judge

- Rep from the Townships Supervisors

- Rep from the Intermediate School Districts

This is Step 1 of the Tax Limitation Alteration process, which is governed by the Michigan Constitution

STEP 2

CATLC Holds Public Meeting

Once the final member of the County Advisory Tax Limitation Committee is appointed, it has 10 days to host a public meeting where it will review financials and determine if an adjustment to the tax levy is necessary to maintain operations.

CATLC is meeting on June 6, at 10 a.m. in the County Courthouse. This meeting is open to the public and will also be livestreamed on the County YouTube channel.

This is Step 2 of the Tax Limitation Alteration process, which is governed by the Michigan Constitution

STEP 3

Board Submits Alteration

The County Advisory Tax Limitation Committee will submit its decision to the Board of Commissioners, who by law, must then place it on a ballot for the public to vote on.

The Board of Commissioners expects to see the recommendation by its Thursday, June 20 meeting where it will be discussed and officially moved to be placed on the November ballot.

No matter what the change is, the Board is obligated by statute to place it on the ballot for the public.

This is Step 3 of the Tax Limitation Alteration process, which is governed by the Michigan Constitution.

STEP 4

Public Votes

The public will consider the change at the November 5 election.

Ultimately, the voters have final say on what levels of service they expect from County government by casting their vote.

Questions?

Fill out the form and we will respond to questions as soon as we can.

© 2024 All Rights Reserved.